Maximizing Capital Gains: Top Japanese Real Estate Markets for the Next 5 Years (Revised)

For global investors, the Japanese real estate market currently represents a rare convergence of stability and growth potential. With the yen at historic lows, opportunities for high-net-worth individuals—particularly those based in financial hubs like Singapore—are unprecedented. However, capitalizing on this market requires more than just favourable currency exchange rates; it demands a precision-focused strategy to identify which specific areas will deliver maximum capital gains over the next five years.

This article forecasts the trajectory of the Japanese real estate market, providing data-driven insights into maximizing capital appreciation. We look beyond the obvious choices to explore emerging regional markets that offer significant upside potential. In this first part, we will detail the key indicators for interpreting the market and the criteria for selecting promising areas.

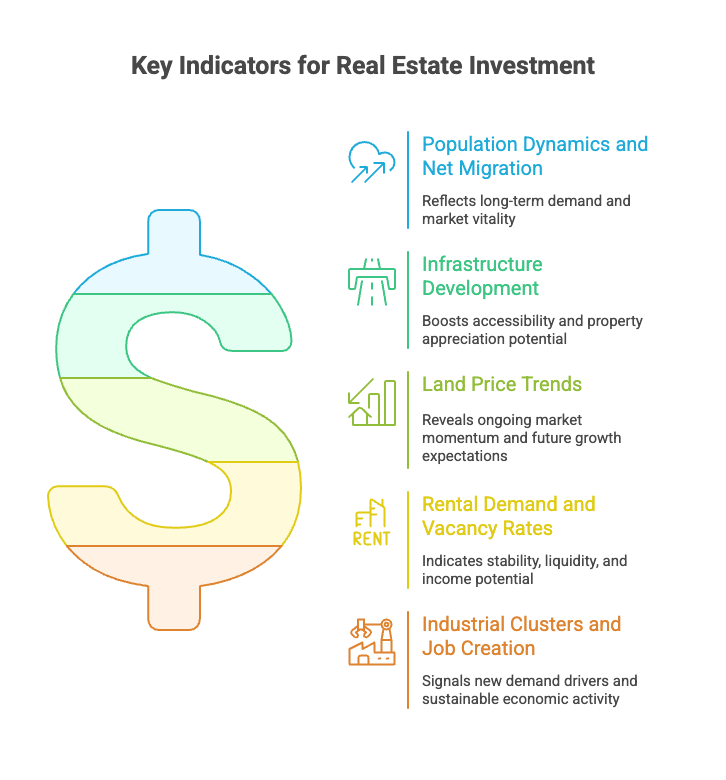

5 Key Indicators for Predicting Capital Gains

Success in real estate investment relies on objective data analysis rather than intuition. To accurately forecast future capital gains, we track five critical indicators. Think of these as the key performance indicators (KPIs) a tech-savvy investor should monitor on their dashboard.

Five key indicators for predicting capital gains in Japanese real estate

Population Dynamics and Net Migration

Focus not just on total population, but on "net migration," where incoming residents exceed those leaving. An influx of younger demographics and the working-age population is a leading indicator of resilient housing demand and market vitality.

Infrastructure Development

Major projects such as new rail lines, highway extensions, or large-scale station-front redevelopments act as direct catalysts for property value appreciation. Projects with completion timelines of several years offer excellent windows for early entry and significant returns.

Land Price Trends

The government's annual published land prices provide a reliable benchmark for market trends. Areas showing consistent year-on-year growth over the past few cycles are strong candidates for continued appreciation.

Rental Demand and Vacancy Rates

Low vacancy rates indicate low investment risk and high liquidity, making for an easier exit strategy. Understanding the specific demand—whether for single-occupancy units or family homes—is crucial for aligning both income and capital gains.

Industrial Clusters and Job Creation

The arrival of large corporations or R&D centers stimulates local economies and housing demand. Clusters focused on growth sectors like IT, biotechnology, semiconductors, or tourism are prime targets for long-term value growth.

The table below summarizes how to interpret these indicators using real-world data.

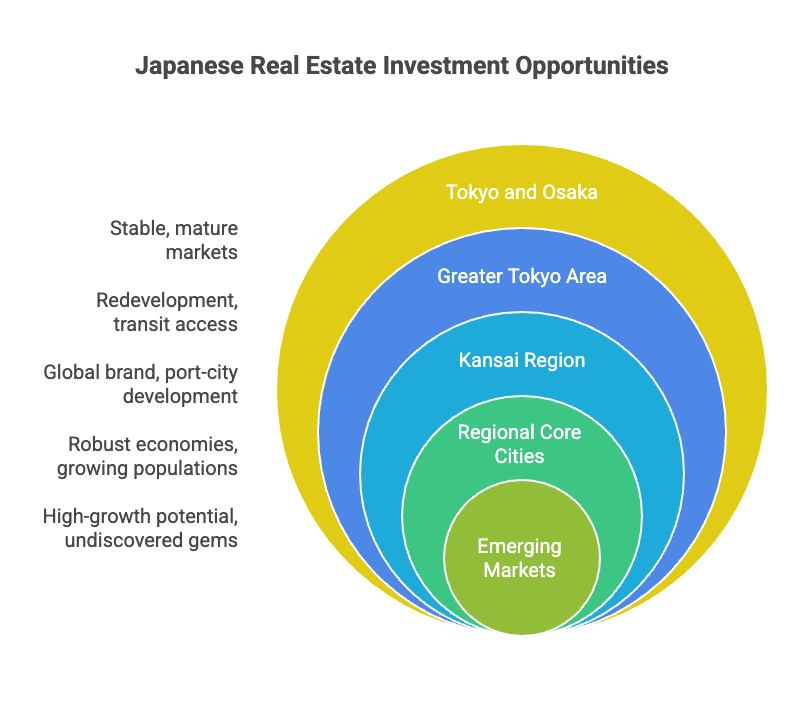

Promising Area Map: Opportunities Beyond Tokyo and Osaka

When most investors think of Japan, they default to Tokyo and Osaka. While stable, these mature markets often come with high entry prices and compressed yields. Agile investors seeking higher ROI are widening their lens to uncover high-potential opportunities across the nation.

Investment opportunity map: From established markets to emerging high-growth areas

Greater Tokyo Area: Beyond the 23 Wards, cities like Yokohama, Kawasaki, and Saitama offer compelling value. Areas undergoing redevelopment or those with improved transit access to central Tokyo are poised for steady growth.

Kansai Region: While Osaka remains a powerhouse, Kyoto's global brand and Kobe's port-city development offer unique investment angles. With inbound tourism rebounding, hospitality-linked real estate in these areas is seeing renewed vigor.

Regional Core Cities: Fukuoka, Sapporo, Nagoya, and Sendai have established their own robust economic zones with growing populations. Fukuoka, in particular, is positioning itself as an Asian business hub under its "Global Startup & Job Creation" special zone status, attracting significant international attention.

Emerging Markets: Certain regional cities possess specific catalysts for explosive growth. Just as Niseko established itself as a premier global ski resort with skyrocketing land values, similar pockets of potential—the "next Niseko" or "next Kumamoto"—are waiting to be discovered.

We have organized the perspectives needed to compare and evaluate candidate areas nationwide.

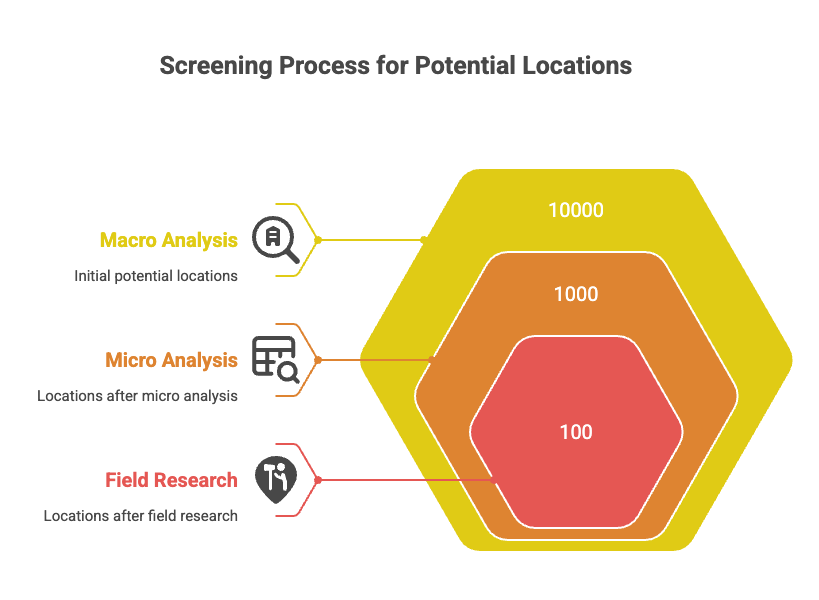

Narrowing Down Targets: A 3-Step Screening Process

To filter through thousands of potential locations and identify true value, a systematic screening process is essential. We recommend the following three-stage flow:

Systematic 3-step screening process to identify high-value investment opportunities

Stage 1: Macro Analysis

Utilize government macro-data (demographics, GDP growth, land prices) to identify prefectures or broader regions with strong long-term growth trends. The goal here is to find markets with structural tailwinds.

Stage 2: Micro Analysis

Drill down to the municipal level. Evaluate specific factors like station redevelopment plans, new job openings, school district popularity, and commercial amenities. Detailed scrutiny of municipal websites and local news often reveals value drivers overlooked by general market reports.

Stage 3: Field Research and Hearing

Data cannot capture the "atmosphere" of a neighbourhood. Visiting the site is non-negotiable. Speaking with local agents and residents provides qualitative insights—and often access to off-market information—that dramatically improves investment precision.

The Potential of Emerging Markets Beyond Osaka and Fukuoka

Comparative analysis of emerging investment markets across Japan

While the potential of Osaka and Fukuoka is well-known, sophisticated investors are already looking for the next growth engine. For example, Kumamoto Prefecture is seeing a surge in activity due to massive semiconductor plant construction, while Ishikari City in Hokkaido is gaining attention as a data center hub. These industrial waves can trigger rapid shifts in real estate values.

Uncovering these hidden gems requires a broad network and specialized expertise.

Property Capture Japan (PCJ) is your specialist partner in this pursuit. Unlike standard agents who wait for listings to appear online, we proactively hunt for hidden gems. Using data analytics and our unique direct network, we uncover off-market properties and identifying high-potential emerging areas before they hit the mainstream. Why follow the market when you can anticipate it?

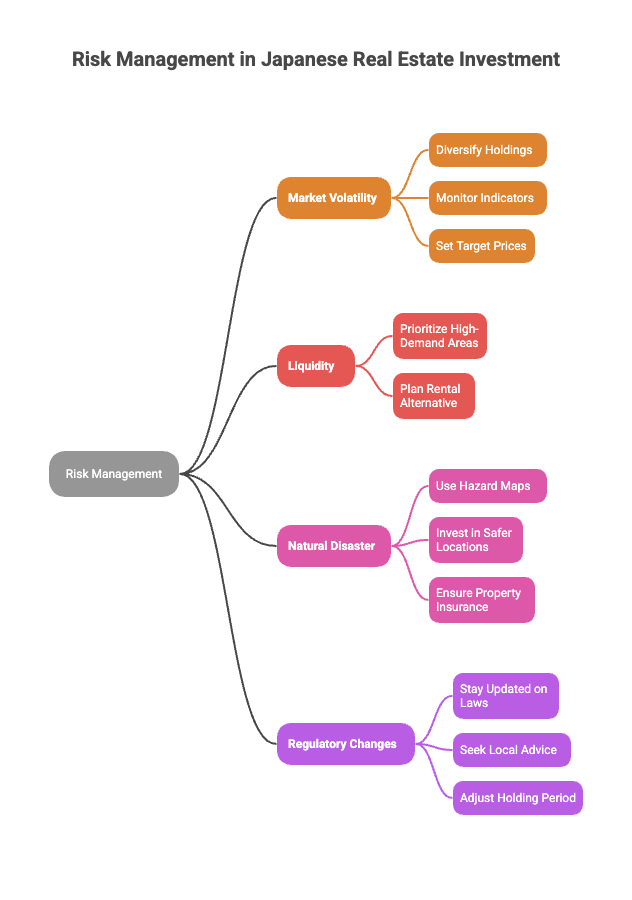

Risk Management and Exit Strategy Design

High returns invariably come with risks. In a capital gains strategy, it is vital to anticipate the following and prepare countermeasures:

Comprehensive risk management framework for Japanese real estate investment

Market Volatility Risk: Economic shifts or interest rate hikes can cool the market unexpectedly.

Liquidity Risk: The risk of being unable to sell at the desired time or price. This is generally higher in regional markets compared to central Tokyo.

Natural Disaster Risk: Earthquakes, typhoons, and floods are realities in Japan. Location selection must account for hazard maps.

Regulatory Risk: Changes in tax laws or building codes can impact profitability.

Managing these risks requires a pre-designed exit strategy with multiple scenarios. Don't just plan for the best case (selling at target price in 5 years); prepare for the alternatives. What is your stop-loss line? At what point do you pivot from a resale strategy to a long-term rental hold?

Frequently Asked Questions (FAQ)

Q1. Can foreigners buy real estate in Japan without restrictions?

Yes. There are no restrictions on real estate ownership based on nationality. Foreigners can own land and buildings on the exact same terms as Japanese citizens. However, the process involves complex paperwork, making the support of an experienced agent essential.

Q2. How much tax applies to capital gains?

The tax rate on profits from the sale of real estate (capital gains tax) depends on the holding period. If held for 5 years or less (Short-term Capital Gains), the rate is approximately 39%. If held for more than 5 years (Long-term Capital Gains), the rate drops to approximately 20%.

Q3. Is managing regional properties difficult from abroad?

Even for remote properties, hiring a reliable property management company allows you to delegate everything from tenant recruitment to rent collection and maintenance. PCJ offers one-stop support that includes post-purchase management.

Summary: Building Future Wealth with Data-Driven Strategy

Comprehensive strategic investment framework for Japanese real estate

The Japanese real estate market is entering a transformative five-year period. The shift from Tokyo-centric concentration to regional revitalization is accelerating, creating new investment pockets in previously overlooked areas.

Maximizing capital gains requires looking past the headlines. It demands cool-headed decisions based on objective data—demographics, infrastructure, and land price trends. Equally important is a robust exit strategy prepared for market fluctuations.